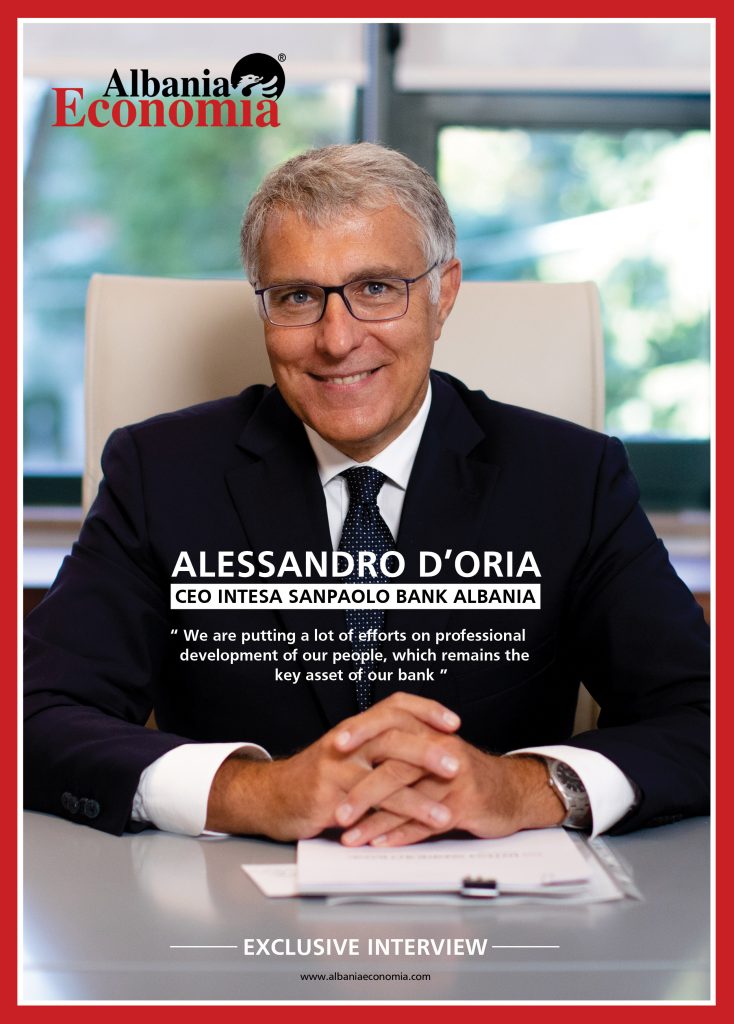

Albania Economia Magazine meets Alessandro D’Oria, CEO of Intesa Sanpaolo Bank Albania, the Albanian subsidiary bank of the Intesa Sanpaolo Group.

It has been one year since you took office. Can you give us draw up a balance?

I would asses that the balance is very positive. When I first joined the Bank, I discovered a Country with a lot of potential. The bank, which is performing well, has great professionals and we are trying to further improve the performances and the cooperation within the different structures. We defined 2022 as a “transformation year” meaning that we are completing or currently implementing many projects about new services and faster processes. The positive results will arrive, even because we are putting a lot of efforts on professional development of our people, which remains the key asset of our bank. The most positive feeling that I am consumed with is about the level of energy (in metaphorical sense): the entrepreneurs have a huge commitment to invest and enlarge their businesses, and the same it is at individual level.

“we are putting a lot of efforts on professional development of our people, which remains the key asset of our bank”

In your position as CEO of Intesa Sanpaolo Bank Albania, what are the challenges that your sector is facing in the current global crisis?

In your position as CEO of Intesa Sanpaolo Bank Albania, what are the challenges that your sector is facing in the current global crisis?

At the given time, the situation is very complex for a plethora of reasons. The war, the inflation, the possible slow-down of growth, the energy crisis meanwhile we are living a redefinition of geopolitical order. Many factors that even alone would be very difficult to manage, are now happening all together and at the same time. At the moment, in spite of difficulties, the banking system looks quite resilient thanks to lessons learnt in the past. The banking sector has closed the 9th month of this year with the highest historical result. The preliminary data published by the Albanian Association of Banks according to the International Financial Reporting Standards (IFRS) show that the profit of the sector reached the value of 19.1 billion lek, an increase of 21% compared to the same period last year. Our bank, specifically, has the best capital adequacy ratio combined with a high level of liquidity. I believe that the biggest challenge is the inflation and the raise of interest rate. Both are touching the repayments capabilities, mainly for households. In order to be prepared, we are keeping high attention to the credit quality and to support properly the economy in this context.

What are Banka Intesa Sanpaolo’s plans for the coming years?

In simple sentence, our goal is growth. We aim to:

-increase our market penetration, attracting new clients and improve lending utilization on individuals, SB and SME and consolidate our presence in Corporate.

– increase the fees offering new solutions for investments and insurances.

-to simplify the processes and digitalize as much as possible.

Our ambition is to offer the best service to our clients thanks to innovation and the commitment of our people.

What sectors to invest in that you would recommend to a foreign investor?

The Country is committed to become autonomous from energy point of view, by the end of this decade. So, I believe that in addition to the investments planned in the area of hydropower (Skavica), the solar and wind plants will also have a huge development, together with all the systems to become more efficient in terms of consumption. On top of this; the hospitality sector is blooming, exploding; however, it has to be properly addressed and invested to offer quality and to become more competitive in the region. Agriculture sector is key as well – the goal there should be to improve quality and increase the quantity of produce to become net exporters. Finally, I think the manufacture sector needs to bring new technology and more automation into the processes. The traditional model of intensive human labor thanks to the abundance of workers and low cost of labor needs to be reviewed and modernized.

“The Country is committed to become autonomous from energy point of view, by the end of this decade. So, I believe that in addition to the investments planned in the area of hydropower, the solar and wind plants will also have a huge development”

Are there still many biases in the perception of the country?

Yes, unfortunately yes. The global ranking about “doing business “are not improving at the expected rate for the country. Albania, with the support of EU and most important European countries needs to proceed and persist into the reforms process but needs even to better communicate the plans and the implementations achieved. Albania has a strategic position in the Balkans, it is the middle of Mediterranean Sea in a moment in which this it is becoming again central. Albania is the door for Balkans, into a process to become full part of EU. I believe the investors and other countries should have the capability to look in this perspective and to overcome the biases mainly related to prejudices.

“Albania has a strategic position in the Balkans, it is the middle of Mediterranean Sea in a moment in which this it is becoming again central. Albania is the door for Balkans, into a process to become full part of EU”

Albania Economia

Albania Economia