In this interview, we have the pleasure of speaking with Adeliada Mehmetaj, the co-founder and CFO of ConsciESG, an ESG Fintech company that offers transparent ESG impact tools to institutional investors worldwide. Adeliada describes how their ESG impact software operates and how it helps investors obtain accurate ESG impact scores. She also discusses the challenges of measuring ESG impact and explains how ConsciESG is tackling them.

Adeliada emphasizes the positive effects of high ESG scoring, particularly in the field of climate action, which goes beyond just attracting additional financing and investment opportunities. Moreover, she provides insights into ConsciESG’s forthcoming ventures, such as the creation of an AI technology that can conduct a thorough and precise ESG scan of a company’s supply chain over time.

Tell us about your background.

There are three people in our core team: Briseida Gjoza, Adeliada Mehmetaj and Shpat Ferizi.

Briseida Gjoza, our CEO, is a born leader. She has over a decade in leadership, sales & management experience for multinational companies. She has previously implemented SDG-aligned projects for UNESCO World Heritage in Senegal, Africa. She is currently an elected official in her city, Elbasan, Albania. She holds a B.A. in Business Administration and European Studies from the American University in Bulgaria. She leads ConsciESG’s business development.

Adeliada Mehmetaj, our CFO, has a Ph.D. in Economics from Drexel University. She was a full-time faculty of Economics and Business Statistics at Seattle University before returning to Albania to start ConsciESG. She holds a B.A. degree in Mathematics and Economics from the American University in Bulgaria. She leads ConsciESG’s R&D.

Shpat Ferizi is our CTO. He has an undergraduate degree in computer sciences from the American University in Bulgaria and an MBA from the University of New Haven. He has 10+ years of experience as a software developer and a track record in entrepreneurship.

Can you tell us about your journey in co-founding ConsciESG and what motivated you to create an ESG fintech company?

ConsciESG started after my return to Albania from a decade in the United States. I met with Briseida who had just gotten out of her general elections campaign and we initially wanted to find a solution to tackle the brain drain problem in Albania from a business sustainability perspective. Soon we realized that we were not tackling just a regional issue, but a global pain point and to maximize the impact of our company to the world, we focused on developing transparent ESG impact tools for institutional investors globally.

It was no coincidence that we co-founded ConsciESG. Briseida and I have known each other since high school. We both attended the Mehmet Akif Turkish high school in Albania, followed by the American University in Bulgaria. We share the same worth ethic, values and vision. We are both hardworking and stubborn to keep going even when things get hard and this past year has definitely challenged us. Being a startup founder in the current economic times is not easy, but we believe that ConsciESG addresses and solves an important global problem, which motivates us to be creative not only in our product but also in our business development.

Regardless of the challenges, we have managed to accomplish a lot in this one year together as ConsciESG. We have secured a global data partnership with Morningstar and Factset, through our selection in the prestigious Fintech Sandbox data residency program in Massachusetts. We have secured our tech partnership with Google for Startups and are currently in five ongoing POCs with leading regional institutions. Aside from the WMF award, we have also won a UNDP Boost award as women innovators from Europe and Central Asia, followed by the Uplift Western Balkans Award. Finally, an announcement, ConsciESG has just received an invitation to the Fintech Sandbox VIP Reception at the NY Fintech Week, which our CEO, Briseida will attend in the last week of April, with the support of EU for Innovation.

Can you explain how ConsciESG’s ESG impact software works, and how it helps institutional investors access transparent and accurate ESG impact scores?

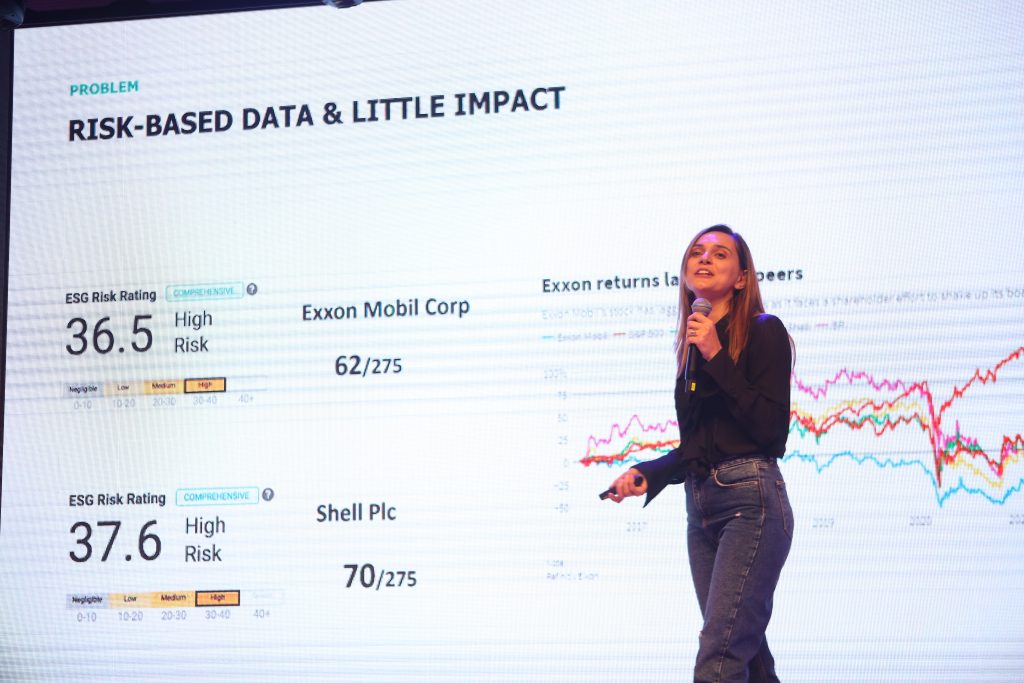

ConsciESG is an ESG Fintech startup that helps institutional investors deploy funds for impact with confidence. We bring more transparency to our clients through an innovative ESG impact scoring framework, stock and portfolio level analytics and are currently working on developing an innovative AI-powered database that will be capable of reducing ESG data gaps across a company’s supply chain over time. Our scores that are derived from the progress of companies on ESG themes, help investors separate true impact from greenwashing. In our product pipeline, we also have planned for the development of a portfolio optimisation tool that helps impact investors to build portfolios that jointly realize higher impact and higher alphas.

In what ways can high ESG scoring in climate action benefit businesses beyond attracting additional financing and investment opportunities? Can you provide some examples of the positive benefits of high ESG scoring?

ESG ratings in the recent years have evolved to incorporate long-term financial risks and opportunities of investments. The environmental (E) pillar score is now much more accurate due to the improvement in the availability of higher quality environmental data. Additionally it is increasingly being used as a tool to align investments with key climate targets such as a low-carbon transition, biodiversity protection etc. Overall, the field is fast evolving and there is an increasing number of innovative products and solutions that are currently being developed globally, in order to help investors align their portfolios with specific climate-objectives in line with the Paris Agreement.

What are some of the biggest challenges in measuring ESG impact, and how is ConsciESG addressing these challenges?

ESG Impact is hard to measure for three main reasons:

- There are existing data gaps which make it difficult to consistently assess impact over time

- There is lack of standardization on what ESG themes should contribute to an ESG impact score

- There is no consensus on what exactly is meant with ESG impact.

Can you tell us about any upcoming projects or developments for ConsciESG, and how you see the company evolving in the future?

We are currently working on developing an AI technology that can perform a precise and full ESG scan of a company’s supply chain over time, which is capable of reducing data gaps for both private and public institutions of all sizes and geolocations.

Parallely, we are also finalizing the model of an investment optimization tool that will be capable of building liquid asset portfolios that jointly realize higher impact and higher alpha.

We will be forever proud of having started ConsciESG from our home country, Albania. Given the niche but very fast growing ESG Fintech market in which we compete, we hope to become the standard for ESG impact scoring and for portfolio impact optimisation tools.

What are the main challenges that a female founder faces when starting a business?

The main challenges that a female founder faces when starting a business based on our own experience are threefold: defying social expectations , accessing funding in a gender-biased environment and owning our accomplishments.

What are the initiatives or programs that support women entrepreneurs and can help them secure the necessary funding for their business?

There are existing programs that support women entrepreneurs, most of them in the US and the EU. Specific ones that we are members of are Graham & Walker, Golden Seeds, UNDP Central Asia & Europe which actually was the first one to support us under their BOOST program of Women Innovators, etc.

On March 15th, ConsciESG participated in the WMF International Roadshow Albania. What was the aspect that you liked the most and what do you expect from participating in the WMF Italy in June?

On March 15th, ConsciESG participated in the WMF International Roadshow Albania. What was the aspect that you liked the most and what do you expect from participating in the WMF Italy in June?

What we liked most about the WMF International Roadshow Albania was the perfect balance between presentations and networking. The investors speed table was very productive.

From WMF Italy in June, we aim to bring the “prize” back home to Albania. We are hoping to meet the right investors and companies which share our vision, to partner with.

Albania Economia

Albania Economia